Analysis of Launch Accelerator Company Pitches Pt. 1: Melengo

A deep dive into the pros and cons of Melengo's pitch deck and whether I'd invest based on this pitch.

Intro:

Today, I’m starting a fun new experiment on All Things VC. Today, I will analyze Melengo’s pitch, one of the seven pitches from the Launch Accelerator, run by Jason Calacanis. Every other day, I will post my analysis on another company that presented at the Launch Accelerator, so after two weeks, we will have analyzed seven companies.

The pitch deck is vital to securing an investment for your company. Sometimes, the metrics speak for themselves, but sometimes, a well-told story has to give the investor confidence that your company can be one of the few per year that truly break out. Therefore, having a strong pitch deck is often the start of an investing conversation between founder and investor, so it’s important you understand what separates the best pitches from the ok ones.

The general slide deck format from the companies we will review in this series and a general slide deck format you as a founder can follow typically looks like this:

A customer’s problem

Your solution

Market size and growth

Traction (revenue growth and customer retention)

Business Model

Why now?

Competition

Team

ROI for investor / Long-term vision

Ask Slide: How much money do you need and why?

These slides can be combined or extended based on how relevant each aspect is for your company, but generally, these are the boxes you need to check in your pitch.

Some general strategies to employ:

Front-load the deck with your company's strongest features (team, traction, technological advantage/breakthrough).

Immediately address any questions or concerns early in the pitch to clear the investor's mind and keep them focused on your pitch rather than the questions they have. This is why practicing with many other people before your formal pitch is so important. You find where the questions are, and you answer them within your pitch.

The more numbers and fewer words per slide, the better.

Tell a story, don’t just regurgitate information.

Exude confidence and optimism.

So, with that, let’s jump into Melengo and take a look at what they did well, what they could’ve done better, my overall assessment of their deck, and why I would or would not invest.

Note: It may be easier to watch a video of me analyzing Melengo’s pitch in real-time via video, which you can see on my YouTube channel here: LINK TO VIDEO. If you prefer to read the Substack, I’d suggest watching the pitch first, generating your own thoughts about the pitch, and then reading my analysis. You can find the pitch here: LINK at the 4:40 mark.

Slide-by-Slide Analysis:

1. Problem

Summary: It takes a long time for this brand designer to iterate on his design ideas since it’s hard to go from drawing to mock-up quickly.

How it’s told in the deck: Starts with the problem by introducing a fashion brand entrepreneur that uses their product for their 3-person team. Describing why that customer uses the product, as Justin does, is a great and interactive way to address the problem. Instead of just a blanket statement like, “Fashion brands don’t have automation tools to iterate on their design ideas quickly,” Justin (The CEO/speaker) confirms a pain point felt by a real customer he’s worked with. This helps tell a story and make it personable, and as I said earlier, the best pitches tell a story that investors can follow.

My thoughts: This seems like a very real problem customers face. I’m sure many fashion designers are frustrated with how long it takes to turn an idea they drew on paper into a mockup. This is a good problem to address, and I suspect many people would pay for a solution.

2. Solution

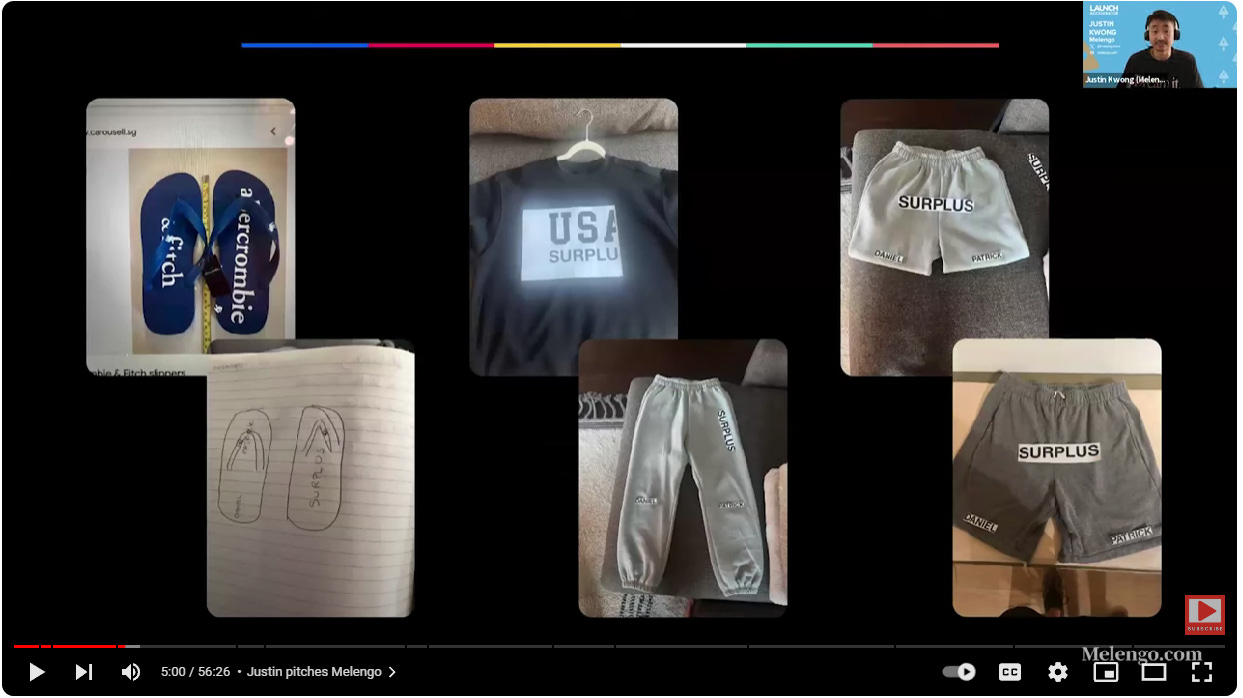

Summary: Melengo helps designers by creating a mock design from a sketch that the customer uploads with any additional instructions he wants to give. An AI co-pilot provides feedback on the best material choice and shows a mock design. The co-pilot sends the files to the factory, giving him the samples in seven days. Then, once he decides that he likes the product, Melengo finds the best prices from factories to make an easy decision.

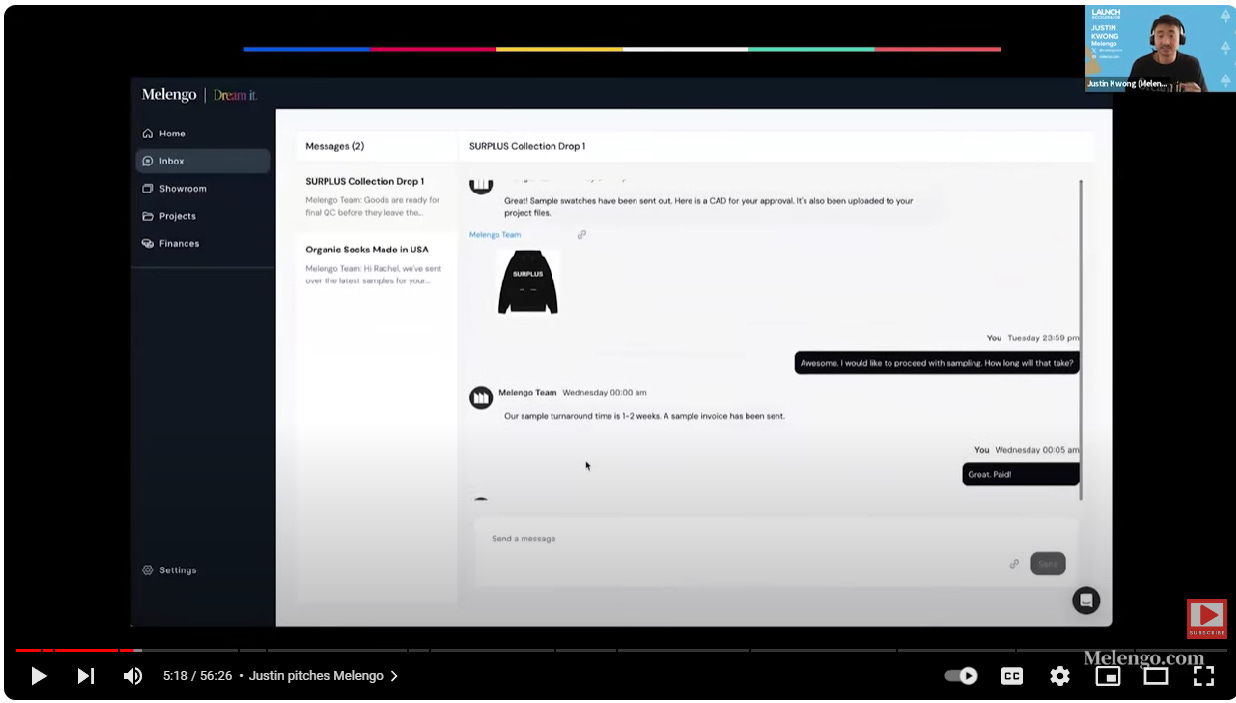

How it’s told in the deck: Justin goes from introducing the customer and the problem to showing a demo of the product, which looks like a ChatGPT interface, while explaining how the product works and how it solves the customer's pain point.

My Thoughts: I love the idea of showing a demo to explain the solution. It helps an investor completely understand the process for the customer to enhance the fact that this is a problem and Melengo is a strong solution to that problem. It is also told in a story that goes from the start of using Melengo to the end, showing how quick and easy it is to use for a customer. Once again, this seems like a real problem users would face, and Melengo seems like a strong solution to that problem.

3. Traction

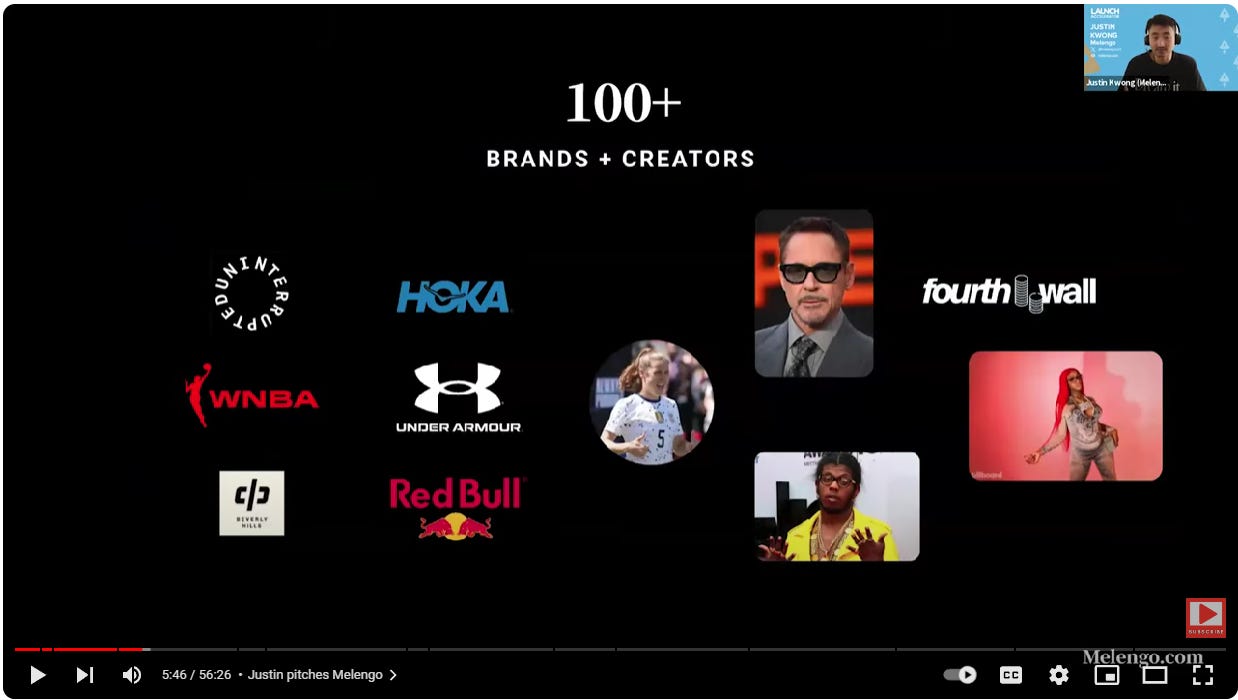

Summary: Melengo has been used by many brands, including well-known brands like Red Bull and Under Armour, and has also worked with individual influencers like Robert Downey Jr.

How it’s told in the deck: Justin shows images of these brands, which I like. It shows that reputable customers use the product, signaling that Melengo is legit, but it doesn’t say too much about how they use the product, nor does Justin explain how they use it.

My thoughts: This slide should’ve been emphasized and elaborated upon further. There were roughly ten images of strong consumer brands and individual influencers that, if using Melengo, could generate substantial revenue. If these were serious clients, I’d expect a high revenue number, so I’d want to know how often these individuals and brands used the product and what for. This could’ve been a slide that made me want to invest, but the lack of explanation makes me concerned about how relevant this information is.

This slide exemplifies how an investor can be cautious or optimistic depending on how the information is conveyed. Had he elaborated on these customers more and their usage, I would’ve been excited or at least not questioning the legitimacy, but by just putting on a bunch of logos without saying much else, this slide actually made me question the legitimacy and gave me a negative impression rather than what should’ve been a positive one. How you tell the story on each slide is vital for this reason.

4. Business Model

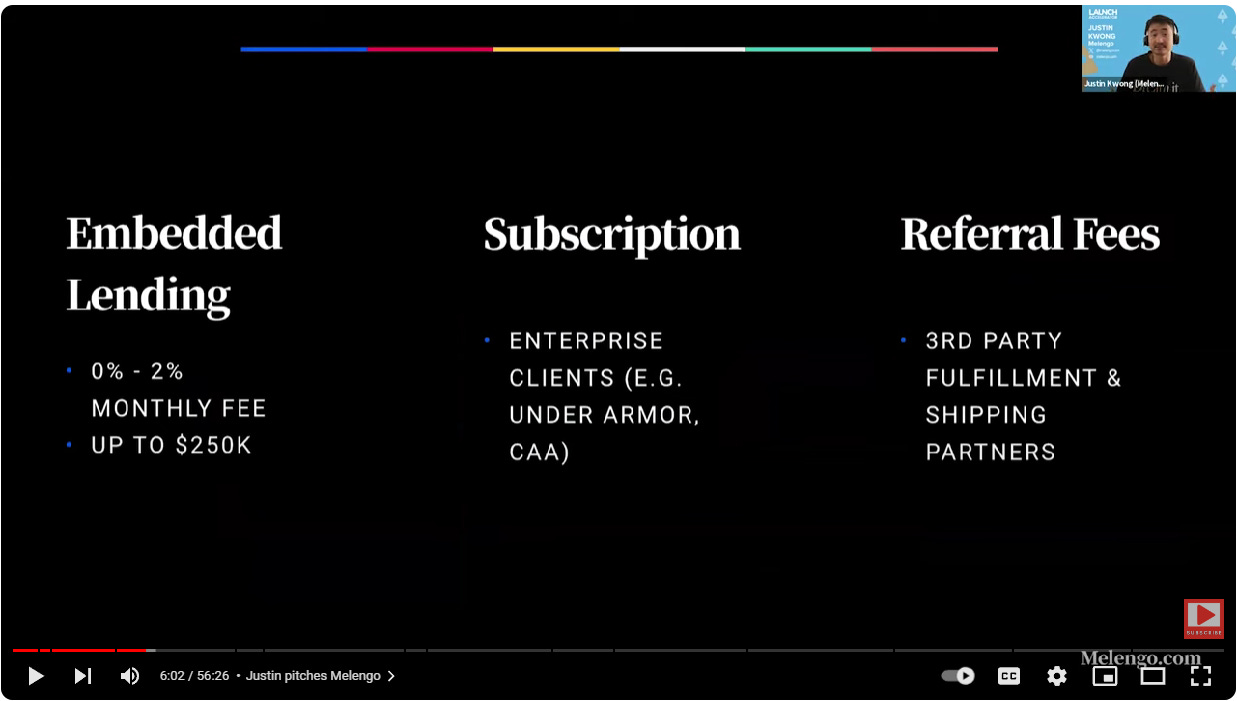

Summary: They earn revenue primarily from a tiered take rate of the purchase order. They also offer lending to large buyers and plan to test subscription services to enterprise customers. Additionally, they plan to charge referral fees to the factories that Melengo sends its users to.

How it’s told in the deck: This was pretty confusing, and I had to listen to this part a few times, even though it’s just a few sentences. The graphic is confusing since it’s just dollar signs. I understand not wanting to share the take rate publicly, but the graphic was confusing. He should just say they take a percentage of all purchase orders on their platform.

My Thoughts: The take rate, lending business model, and factory referral model all make sense as revenue streams and are good two-sided revenue streams, but he introduced a subscription model for enterprise customers but didn’t explain how that worked. It seems like they already have some enterprise customers like Red Bull and Under Armor, so how would they pay you through the subscription model? Are they already paying you through this subscription model? That I would like to know. It raises another question about the legitimacy of these enterprise customers.

5. Traction

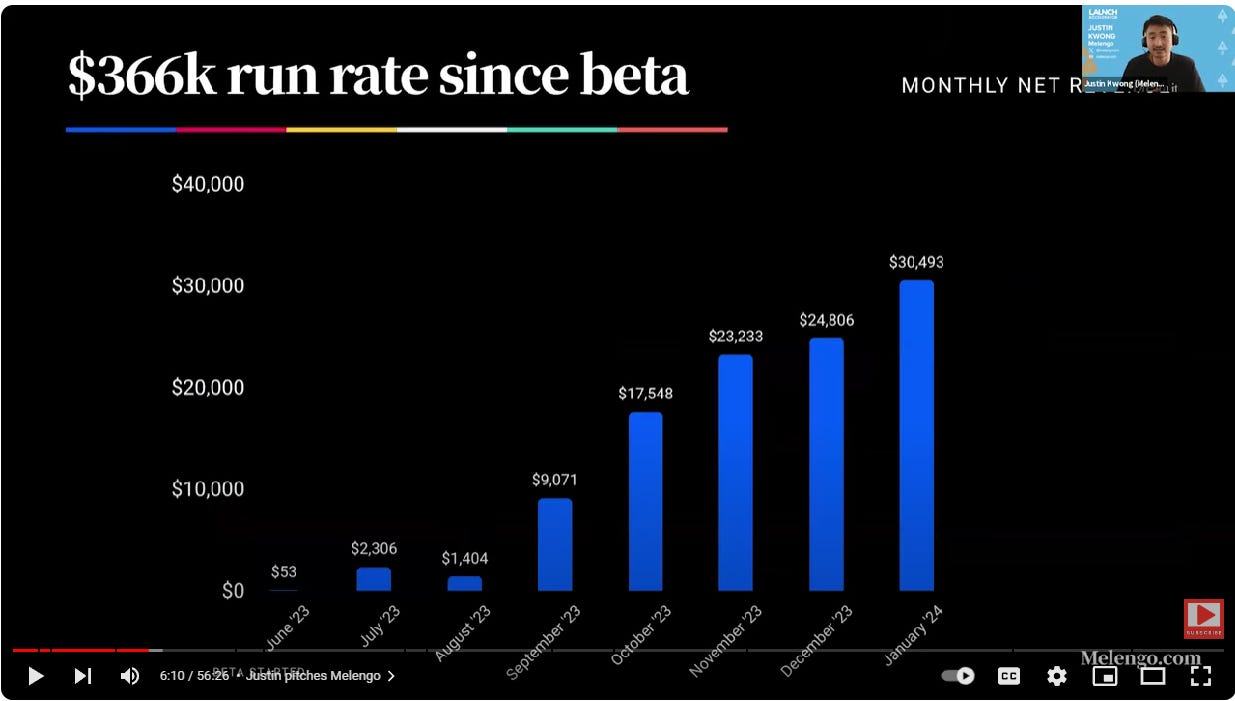

Summary: Melengo Went from $53 in revenue in June 2023 to $30,000 in revenue in Jan. 2024

How it’s told in the deck: This is a fine, standard chart. It's always good to show a chart regarding revenue growth.

My thoughts: It’s pretty janky, with some months growing much faster than others, so I’d want to know more about why that is. Also, it’s worth noting that this is not recurring revenue, which is a concern for many investors. I don’t have too much of an issue with it because it’s a volume business model, as in the more the customer uses it, the more they pay. I think this model better aligns incentives and helps reap the rewards from whales, who will likely spend more on a volume basis than whatever a subscription fee would be. In general, it’s nice to have an average CMGR number to help investors easily understand the MoM growth rate since that’s an important metric for an early-stage startup. Its omission here tells me that it’s not a very good number.

6. Why Now?

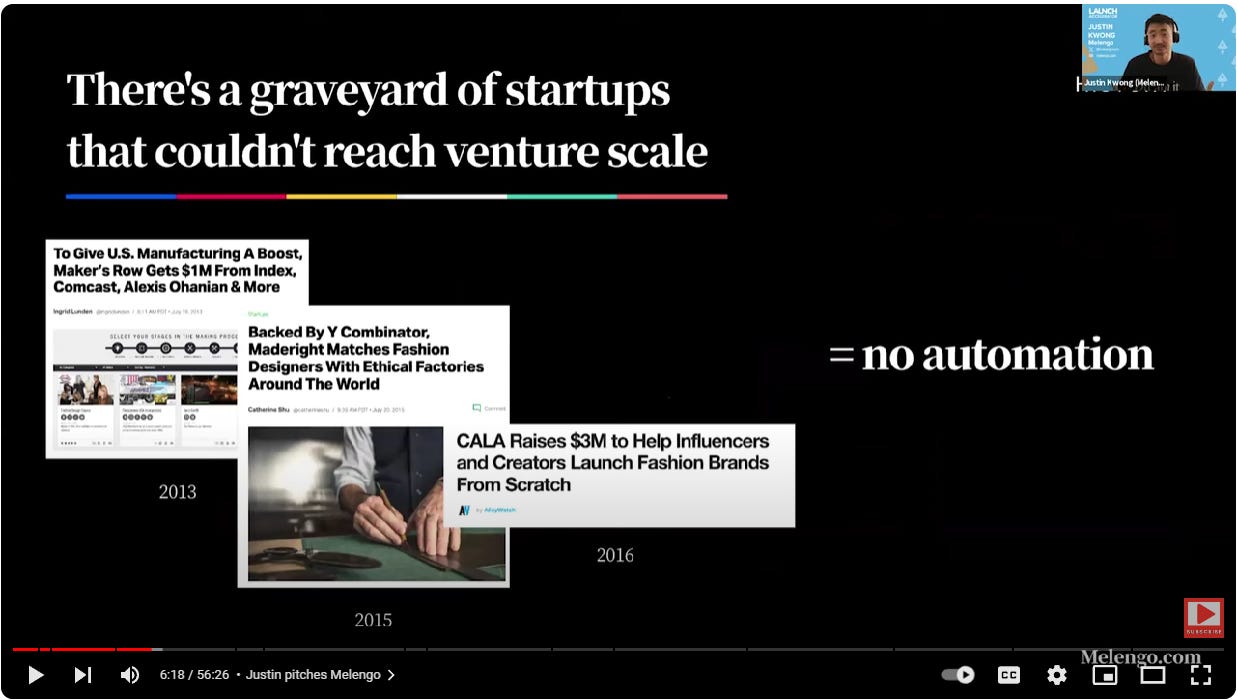

Summary: Many fashion manufacturing startups have failed because they couldn’t automate their way to venture scale. Now that Melengo has this co-pilot that works with the designers and the factories to give answers quickly and easily without the designer and factory having to speak with one another frequently and ship multiple items back, it should create a much better process than was previously offered.

How it’s told in the deck: A few images of news articles showing failed fashion manufacturing companies with a graphic showing their missing piece was automation, which Melengo has, and then going into another product demo reinforcing those features.

My thoughts: I didn’t like this slide. You’re not only selling me on your product, but you’re selling me on the market. The fact that no startup has succeeded in this industry, as Justin called “a graveyard” (which I would avoid negative terms like that in a pitch. Keep it positive), makes me less confident that you can be the one that figures it out. I understand that your processes are much better than what has been done in the past, and you’re leveraging AI to automate the process much better than past competitors. However, it’s still not very reassuring that you can succeed since there doesn’t seem to be a proven player in the market. I would’ve rather seen one of these companies be successful, and then you say, “This company is successful, but users complain that the process is too manual. Since we automate it, we believe we can take their customers.” That shows that there are underserved users in a proven market. Without that, Melengo is basically saying they can create a market, which is possible but very tough.

7. Competition:

Summary: It doesn’t seem like they have much competition, according to the options he chose for this graphic, but in terms of the competition Justin presents, Melengo seems to have many more features.

How it’s told in the deck: Lays out an image showing Melengo having four key features and three of their competitors having zero, one, or two of these key features. A typical competition slide to highlight your strengths that show how you can beat the competition.

My thoughts: I don’t think this is a great competition slide because I don’t think these companies have too much to do with Melgeno. He mentions Alibaba, which is just a marketplace. I’m not sure what that has to do with design creation and iteration to then generate a factory order. He also mentions a competitor that shares no similarities with Melengo, which means they aren’t even a competitor, I would think. This reaffirmed my concern that no one is building something like this potentially for a reason because there’s no market for it.

8. Road to $100M in Revenue (ROI on investment)

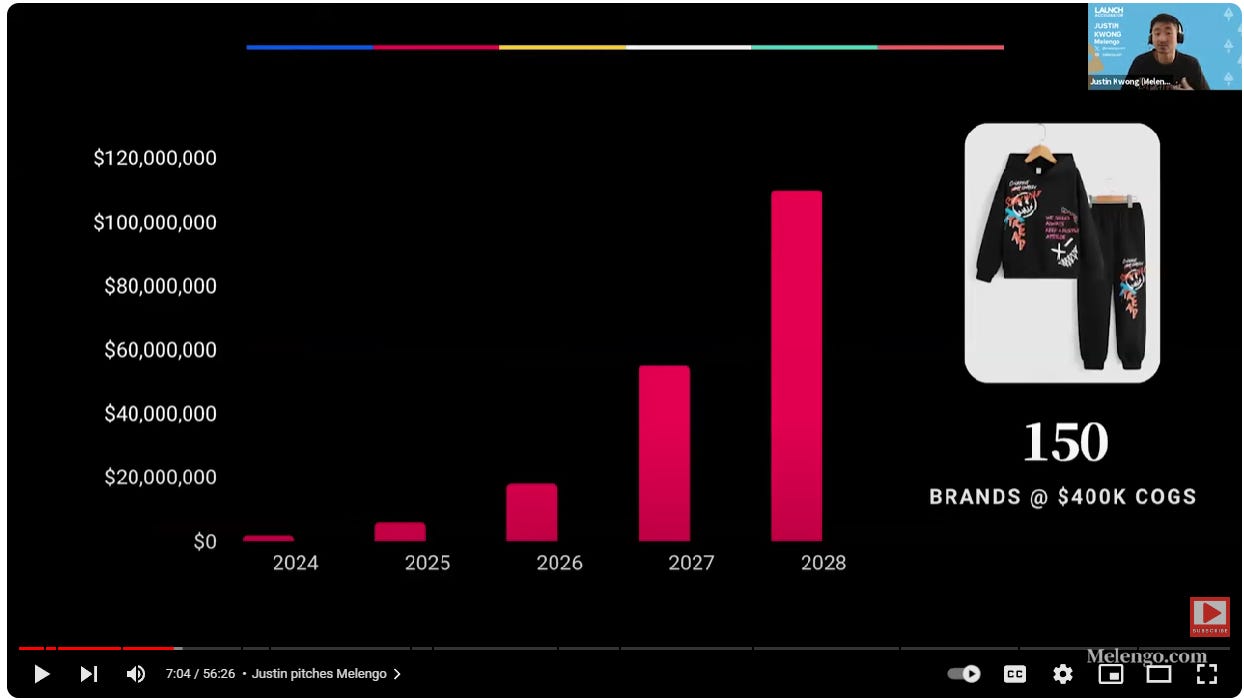

Summary: Justin claims Melengo can reach $100m in revenue by 2028 and $10m by 2025 by having 150 brands spend 400k in COGS through Melengo. They plan to reach $100m by expanding to more fashion products, not just the current selection of hoodies, t-shirts, joggers, and leggings.

Pitch Deck: This is a pretty standard chart showing growth with some graphics enhancing how they intend to get there. It doesn’t say much but it says enough about how they plan to hit these audacious numbers.

My thoughts: I think it’s very optimistic to go from maybe $1m in revenue in 2024 if they keep growing fast, which I’m not so sure about based on how inconsistent their growth has been, to then $10m in revenue in 2025. That’s almost an average of your 2024 yearly revenue per month in the following year. I would need to dive into their numbers and customer behavior metrics to see why they think this can happen. I think 150 brands doing 400k in COGS is a reasonable goal for Melengo, and I could see that happening, but for that to happen by the end of next year is a little too optimistic based on what I’ve seen and heard in the pitch.

I also want to see a breakdown of how many individual brands and enterprise brands are providing how much revenue out of the $10m they intend to earn because those are very different customers with very different sales and marketing strategies, so there has to be a plan for how to earn revenue from each segment.

9. Team:

Summary: Deep domain expertise. One bootstrapped a fashion brand, and the other co-created Nike’s largest textile program. Justin also mentioned how Jason Calacanis and Cyan Bannister (who led the pre-seed round) are investors.

Pitch Deck: Standard team slide with the two co-founders and logos showing their experience.

My thoughts: Very reputable and relevant experience from the team, which is good because they should understand their customers, which their customers will appreciate. Also, I was very surprised to see a GOAT like Cyan Bannister leading the pre-seed round after I was pretty uninterested in this company during most of the pitch. I will say the team slide at the end gave me some confidence that perhaps this team can pull off something spectacular based on their relevant experience, but I just don’t see how they can essentially create an industry that has failed so many times in the past. It’s hard to have confidence in that. However, Cyan Bannister leading the pre-seed round makes me feel like I’m being short-sighted. I would love to talk to her about why she led that deal.

Overall:

Overall, I thought it was an ok pitch deck. It is fairly standard; nothing too interesting. I thought the product demo was great and gave me a good idea of how the process works. Melengo seems to be solving a customer's problem, and I love how Melengo explained that problem

I would’ve liked to hear more about why they have so many reputable customers like Under Armour and Robert Downey Jr., and I’d love to hear more regarding how they’re using the product. If they are coming back frequently, that’s a very encouraging sign, but if they just used it once, that’s not a great sign.

I also would like to know why their revenue chart was so inconsistent. It seemed like they’d hit a big bump, and then the following month, not much would change. I’d want to know why. Why wasn’t there an increase from Nov. to Dec.? Shouldn’t there have been a holiday season bump?

If there were strong answers to these questions, especially to how big brands and influencers used the product (strong retention), then perhaps I’d invest. However, the graveyard of startups that have tried to build something like this before, the inconsistent revenue growth, and the lack of competition in the space would make me pass on this company if given the option to invest.

Pitch deck: 5/10

Things I liked about the pitch:

Good product demo that helps you really understand the problem and how they’re solving it. I love the customer example to solidify this point. Seems like a real problem that customers would face and Melengo seems like a promising solution.

Very applicable team to this problem, and they described their industry experience well in a way that gives me confidence that this is a great team to address this problem.

Things I didn’t like about the pitch:

Vagueness around the top brands using the product. How much have they spent? Are they coming back? Why or why not?

Vagueness around the business model and how many customers in each bucket (individual and enterprise brands) are paying them.

Inconsistent growth in the revenue chart makes me concerned about how well they solve this problem they’re addressing.

The why now slide. I understand using these AI tools that just came out makes a product like this more feasible than in the past, but calling all past competition a graveyard of failed startups gives me more concern that this industry may not yield a successful business even with Melengo’s technological advances.

The competition slide didn’t really have real competitors. Some weren’t similar to Melengo, so it just reiterates my point that there’s no competition in this market because it hasn’t worked before. I’d prefer to see at least one proven competitor that confirms the market exists, to which Melengo can say we are better than them because of x, and therefore, we will take their customers.

My Investment Decision: Pass

What would change my mind:

Knowing how the top brands use the product. If they use it a lot and come back frequently, that might be enough for me to invest. Also, I need to hear a little more about how they can create a market that has seemingly failed in the past. I would need a really convincing story that Melengo can be the one to break out due to the new technology at their disposal.

Thanks for reading, and I hope you enjoyed this post because I have six more quickly coming your way. As I mentioned before, if you want to watch a YouTube video of Melengo’s pitch with my commentary in real-time, you can click the link here. Don’t forget to subscribe and like while you’re there! Stay tuned for Thursday when we dissect another pitch from the Launch Accelerator with many different lessons to learn from.