Initialized Capital: Five Questions

Five Questions I'd Ask Founders If I Were a Partner at Initialized Capital

Every week I do a deep analysis on why VC firms invest in the companies they did. To learn alongside other curious innovators, subscribe below!

In this post, I reviewed some notes that didn’t make it into last week’s Initialized Capital essay on why they invested in Coinbase, Instacart, and Rippling. If you want to learn more about Initialized, I suggest starting there.

I used those notes to generate five questions I’d ask founders if I were a partner at Initialized Capital.

While I don’t know whether they actually ask these questions, I have many direct quotes from current and former partners about what they look for in founders and questions they ask founders when determining whether to invest in a company. Therefore, I can extrapolate some reasonable questions.

I think this will be a helpful thought exercise for founders who intend to raise to think about your answers to some of these questions as I believe they are questions an investor would ask whether Initialized Capital or not, so it’s good to think about.

For investors, it’s good to think about the questions you like to ask founders and why and read some of these quotes from Initialized Capital partners, who are certainly some of the best investors in the world, so it’s worth reading this information and maybe adding some of these questions to your list if you think they’re effective.

Let’s get started.

1. What Have You Built?

For those who listened to the previous episode, one thing rang true across all of the investments we discussed in Initialized’s portfolio: they were founded by builders. If you go to the Initialized website, I bet you’ll quickly see some references about how they only back builders.

We touched on this in last week’s essay regarding how Initialized was initially very interested in Brian Armstrong and Apoorva Metha because they build the MVPs of their product themselves. They assumed people would be interested in what they had to offer, but instead of doing market research or pulling as much data about consumer behavior as they could to use to pitch investors, they just built the product to confirm whether users would want it or not.

Jen Wolf talks about how much Initialized loves to engage with these founders, who build the product to test their thesis. She once said,

“They're people who like to build things to solve problems. They don't want to just talk about it or research it. They are very action-oriented, and they said, like I've identified this problem, and this is how I'm gonna start to figure out how to get product market fit or how to solve the problem. I'm going to create the product and put it out there, and that's going to be my main way of trying to understand whether this is something people want or need.”

Initialized loves this trait so much because builder-owners of a startup can move so fast. If they have an idea for a new feature or want to reduce friction in a process after talking to a user, they can just sit down for a few hours and do it. They don’t have to coordinate with a team to get it done; they can just do it themselves.

As we’ve discussed many times, startups need to move fast because it is one of the only advantages they have over larger incumbents. The faster you can move, the better, and being able to go from idea to product immediately helps you move fast.

The Initialized team believes in this concept so much that they really don’t care about credentialism. They often say they don’t even look at founders' resumes at times because what’s more important to them is seeing what the founder has built. Garry Tan discussed this in more detail as he said,

“We like to see what you built. That's really powerful. I don't want to see your resume. I don't really care where you came from. I want to see what you built and I want to see what your customers say. A lot of the resume thinking, the check box thinking, actually doesn't work.”

This is interesting because many pre-seed/seed investors care most about credentialism, which, when investing at purely the idea stage, is really the only thing you can base your investment on, so it’s understandable. Initialized invested in Rippling at the idea stage because they knew Parker Conrad’s history as an exceptional builder and executive.

But Initialized is unique in the fact that when there is an MVP on the table to review, that is valued higher than the founder's experience and formal credentials. The initialized team would much rather support Apoorva Metha, who worked at Amazon for two years as an IC, which is notable, but he also was just launching unsuccessful startup after unsuccessful startup, which is kind of a red flag considering he launched somewhere around 20 companies in two years.

What’s to say the 21st will work? And what’s to say this inexperienced 27-year-old would be the one to make something as hard as grocery delivery finally work after many failed attempts by others?

So many investors would pass based on this resume and work history, but Initialized loved the product Apoorva built and could see he was willing to grind on this project himself to make Instacart as successful as it could possibly be early on. Luckily, they loved his willingness to build a janky and extremely unprofitable MVP so much that they invested at the earliest possible stage, which, as we know, delivered them a massive return.

So, If I were a partner at Initialized, I would love to see an MVP. If you come to the meeting with just an idea but a history of building great products, then we can talk, but if you can come to the meeting with an actual demo, then I will be a lot more excited for our meeting and your chances of raising capital are much higher.

While this is especially true for Initialized, founders, I suggest trying to have an MVP anytime you pitch an investor. Trying to raise money before building the MVP to de-risk your personal financial outcomes will cause you to spend more time fundraising and less time growing. It’s better to take time building out an MVP and then raising because then the fundraising process should be quicker, and you should be able to get in front of more notable and better-connected investors.

The worst-case scenario is you leave a meeting without funding but with insight on how to improve your product from investors who have seen thousands of demos. That’s valuable.

2. Why has this not been built yet?

This is a very important question every investor should ask a founder during a pitch. Some investors frame this question as “Why now?” which is a similar question, but I’m asking, “Why has this not been built yet?” as a slightly different spin on the why now question that better relates to Initialized Capital’s thesis.

A strong answer to this question would be that it’s a boring industry to most people. The canonical example in Initilaized’s portfolio is Flexport. Hearing founder and CEO Ryan Peterson talk about the shipping process and how many regulators and stakeholders there are tracking every little detail of every package in such a slow and archaic industry gives me a headache.

It sounds like a challenging, frustrating, and boring industry to operate in. Thus why we’ve never had a company bring effective software to shipping as Flexport has done. It’s not exciting! People want to build the next Airbnb or Uber. That’s so cool!

But, as an investor, that typically doesn’t make me any money because those industries are already so saturated. Uber, Airbnb, Instagram, WhatsApp, LinkedIn, and so on are exceptional products and juggernauts. How are you going to be so much better than them with a minuscule fraction of the resources to take their market share? It’s basically impossible.

That’s why Initilazed loves to back founders that make boring industries exciting. Partner Alda Leu has an interesting quote on this. She once said,

“If you can take a boring industry and make it exciting, that shows a lot of skill, and that skill can translate into more fundraising into recruiting into business development partnerships. It actually is a talent.”

Ryan Peterson made Flexport cool! Or said another way, Ryan Peterson made freight shipping cool! Don’t get me wrong, ports look really cool. I still have that child-like awe when I see the massive scale of the operation, but then, my head begins spinning in how this operation can be efficient. It must be a brutal industry, but Flexport seems like a great place to work because they’re taking this boring and disorganized industry and bringing software to it to solve interesting and challenging problems, which is pretty damn exciting!

So, if I, as a partner at Initialized, see a founder come in and talk about tackling a major problem in a super boring industry that no one wants to touch, then I’m feeling very bullish. If you can muster up the strength to go after ocean freight, or workers comp, or HR onboarding processes, and showcase your knowledge of the industry and passion for disrupting it, then I’m likely very inclined to invest.

When asking this question, the second trait I’d look for in the founder is anti-mimetic thinking. We touched on this in the last episode as a big reason Garry Tan was so bullish on Coinbase before anyone else.

Well, Brian Armstrong, founder and CEO of Coinbase, believed that this coin, with less than a $150 million market cap, could eventually become a new gold standard and the foundation of a global currency without government intervention.

That is quite the anti-mimetic thinking there.

The U.S. Dollar, Euro, and Chinese Yuan have trillions of dollars in circulation, backed by decades of staying power, government and militaristic support, and global user adoption. How was a digital coin known by less than a million people in the world supposed to uproot that?

Certainly, an extremely difficult question, but Garry was willing to invest in Brian to solve it. Since VC is such a power law industry, you have to be truly exceptional to be a multi-billion dollar company. Like I just said, no one wants to back another Airbnb or Instagram. It’s been done. We need something new. Or today, no one wants to back another Coinbase because it’s already been done.

But in 2012, there was barely anything like Coinbase, and nothing as user-friendly as what Brian was able to build. Since startups and venture capital are a power law industry, Garry Tan believes so firmly in anti-mimetic investments as he once said,

“We often ask ourselves, what do we believe that nobody else believes? We ask the founders that too. If there isn't one of those things embedded in an anti-mimetic aspect to the business, often we don't want to fund it.”

Funding a company trying to be the next Coinbase is much less appealing than funding a company taking on a boring industry in which no one else is building. That means the playing field is wide open, and I can back a strong player to take that industry by storm and beat the competition to the finish line before they even start.

Anti-mimesis essentially gives a startup first-mover advantage, which is ultra-valuable in industries with network effects (the product/service improves as more people use it [Instagram] and high switching costs (So much time and money has been invested in this product, it’s not worth going to another service [AWS].

So, founders, try to avoid building another social network or dating app. Try to build something exceptionally unique in, ideally, a boring industry, and make that industry exciting to show that you can attract exceptional builders to work on that problem with you. I guarantee you will land a meeting with Initialized Capital if you take that route.

3. What is your experience in this Industry?

So, as I briefly touched on in the last section, I’d love to back an anti-mimetic founder going after a boring industry, but that founder has to display expertise in that industry since it will likely be really hard to disrupt.

Now, when I ask about experience, it’s kind of a trick question. From the Initialized lens, I’m more interested in founders who maybe didn’t work their way up Salesforce and now believe they can build a better CRM; I’m looking for the Brian Armstrongs, who took a hobby interest in Bitcoin and made it into an obsession.

I articulated this well in last week’s essay, so I’m bringing it up here again.

What’s interesting is that Brian Armstrong was by no means a Vitalik Buterin type who studied crypto for many years before starting a vital piece to the ecosystem by creating Ethereum. Armstrong actually worked in the anti-fraud department at Airbnb before it was even a $1 billion company.

He was just curious enough to explore this idea further and used his engineering abilities in security to build an exceptional product, the MVP of which he built in just a few weeks.

Interestingly, seeing a founder create founder-market fit is more exciting to Initialized than someone with natural founder-market fit. Current Initialized Managing Partner Brett Gibson describes why this is such a bullish signal as he said,

“There's always this concept of founder market fit, and in some technical domain, sure, you need to have worked a long time in Rockets to create new rocket engines, but I think there's a wide swath of the opportunity for very smart technical people to will themselves into founder market fit.

To learn everything about a market. We get Founders that are talented and second-time Founders, and they just pick something entirely different, and they go out, and they just make sure they know everything about it, and they just decide to become experts and decide to have fit for a given Market.”

It's remarkable that Brian went from an enthusiast to a full-on creator of a platform that services this need in a few weeks. Think about what he could do with years of effort on this project if that’s what he could do in a few weeks!! It’s a remarkable signal that showed Brian had strong potential as a founder to build something world-changing.

So why did Brian Armstrong drop everything at Airbnb to work tirelessly at creating an easy-to-use Bitcoin transaction service? Because he was obsessed with the problem. Partner Brett Gibson talks about how obsession is such a strong signal as he once said,

“The word grit comes up a lot, and I think that that's important, but when I was thinking about what's happening in early stages… the thing that I was looking for as a proxy for whether or not an entrepreneur is actually going to do something is a little bit of obsession.

You find that Founders who are a little bit encyclopedic about the domain they're working in have done a lot of work. If you can't stump them in the pitch and they've learned everything that's going on, and they're really obsessed with their idea, and they're thinking deeply about the market opportunity and how they've talked to all the customers they can, that's a really good signal.”

Brian Armstrong is a great example of an outsider perspective coming in and studying hard to be an expert. He created founder-market-fit, and that’s extremely interesting. On the other side of the coin, Ryan Peterson was obsessed with ocean freight for a long time.

How obsessed? Well, he spent several years in China studying it from the largest exporter in the world.

That’s pretty obsessed!

Peterson knew everything about the industry, and his future customers. He built connections with a thorough rolodex before even starting Flexport. I mean, what an excellent founder to back. I suggest you watch a video listening to him talk about the early days of Flexport because he just rambles on fact after fact that are just so niche, and I suspect very few people in the world know.

I’m sure the Initialized team just listens to him talk in awe because it’s so remarkable how much he knows since he’s truly obsessed.

So, there are two answers to look for when asking about the founder's experience in this industry. You can find the Brian Armstrong type who is an outsider but so deeply interested that his learning curve looks exponential, and one you expect to continue in time to earn him the title of expert.

Or, you can back the Ryan Peterson archetype that has a more linear curve, but you’re meeting with him when he is already near the top of that curve.

Either founder is very backable, but any founder between those two extremes is much less appealing because they likely aren’t very obsessed. So, founders, take either route, but take a route, and investors, don’t back a founder you don’t feel is absolutely all in on this problem, whether they have natural founder-market-fit or are rapidly creating it as an outsider.

4. How do you know this is something your customers want?

So, while most of this essay I’ve been talking about build the product, build the product, there’s one slight caveat: build something people want.

Even companies we’ve discussed, like Coinbase and Instacart, knew their product would be something people want. Brian Armstrong knew people were interested in buying Bitcoin but hated the current transaction services, and Apoorva Metha hated going to the grocery store and knew other people did, too. These were actually pretty easy problems to recognize a need for. Interestingly, the Instacart problem was obvious, and the Coinbase problem was a little more niche, but nonetheless, these founders knew these were problems users wanted solutions to.

Sometimes, identifying problems requires a little more user research to ensure this is something people want. Current Initialized partner Parul Singh has a great quote on doing user research before creating an exceptional product. She said,

I think when we started out building things, it used to be about just functionality, how easy is it to do this? Like usability, right? Like how easy is it to go through these workflows? And the way that that's helped me as an investor is that I also believe that if you're not building for like a really strong need, then it's pretty impossible to build a high growth company. And so I think sometimes my user research skills helped me a lot because then you can try to understand how bad is this pain point that people are solving for.

So, we talked about building something people want, which is pretty straightforward; however, as Parul states, a lesser-known aspect of this is designing the product in a way that most appeals to the user.

Sure, Parker Conrad knows HR teams hate using so many different platforms to onboard new employees. Rippling should create a platform for them. That’s an obvious problem.

But to be a great product that users love, you have to build it in a way that appeals to them. You have to design the platform, workflows, and functionality so that HR professionals can easily learn how to navigate the platform, and all of their most important needs are most prevalent.

Parker could’ve guessed what HR professionals would have wanted based on his experience, but by talking to customers he not only knows TO build an HR platform, but HOW to build an HR platform that his users will love.

So you can’t just do market research and look at data to see if this is something customers want. And you can’t even build a product that solves a need solely on your own opinion. If you do either, you won’t have the true perspectives of all individuals facing this problem. Once you extract information from users with a large enough sample size, you can determine how to build the product to solve the problem for the user in the easiest and most effective way.

The second portion of the answer I’d be looking for in this question is some type of emphasis on the founder’s relationship with their customers. Not only have the founders talked to them, but how often do they talk to them? How do they handle their questions or issues with the product? What additional features are they looking for?

I think it’s vital that you talk to your customers early on to find out what they want, but it becomes increasingly important that you continue to engage with them to ensure they’re always getting the best user experience possible and that no one leaves for a competitor.

So, this is kind of a stretch to be mentioned in this question but I absolutely love these rules for fanatical customer support that Garry Tan lays out here. If I see a founder practicing these actions, then I’m very bullish on him or her. Tan described fanatical customer support as,

Answer every email (within 10 minutes)

Feel the pain your users are experiencing

If one person emails you, there are 10 or 100 other people who have failed there

BE THANKFUL. They are doing you a favor

Fix the problem ASAP

Be as authentic as possible - “I’m the CEO, how can I help?”

First, founders focus on #3 and #4 there. Customer feedback is so important to a product, so if one customer is frustrated enough to actually take the time to email you about it, expect that many other customers are feeling that pain point and be grateful that they’re taking the time to let you know about an issue in your product.

If a founder can prove to me that this is his or her process constantly for his or her company, I’d be ecstatic. It shows you really care about the problem you’re solving that your customers are feeling. Which you should, or why did you even start a business?

Also, it’s nice to have principles such as these, but ideally, the founder can prove it. Take Rippling, for example. Parker Conrad is and always has been obsessed with customer service. So much so that they publish all of their customer support data about how fast they respond or how well they resolve the customer’s problem. They care about this so much that they even put up a billboard to highlight their response time.

I love that. I want that type of founder. A founder who knows exactly what his or her customers want not just while building the initial product but throughout the entire life of the company.

CEO/Head of Customer Support.

5. Why should I leave my job to join your company?

So, today's last question is one the Initialized team loves to ask themselves in internal partner meetings, which they should. I think this is an excellent question to ask when debating an investment.

It’s personally how I think about whether I want to start a new project. I, as I’d assume most VCs are, am very curious. So many things sound so interesting to me, and I always think how fun it would be to dive deep into that compulsion. But typically, once I start diving in, I find it would be way too hard, the day-to-day isn’t as fun as the end goal sounds, and I don’t know enough to produce a good outcome.

But, there are some companies for me, like Cruise, an Initialized portfolio company, that sound really interesting and would’ve been a fascinating problem to work on, much as I’d assume Garry Tan must’ve felt when he led that investment. He once said,

“It's like, "Hey, this person made a thing that's awesome. If they can make this, they're going to attract other people who can recognize that this is awesome. Through the like attracts like principle, this is going to be a magnet for all the other smartest people who know how to build."

I think that's underrated, actually. People don't realize this, but people who are really, really good at building really like working with other people who know how to build. That's the real currency of being able to build software in Silicon Valley is actually where the builders go, and where they want to work, that tends to be the thing that is the future.

We still use that as one of the primary things that we look for when we sit across the founder is if I weren't doing what I'm doing now. If I were going to go look for a job, would this be one of the top 10 places that I would want to go work at? Can you convince me? Then we look at all of each other with all of these different backgrounds. It's like, would all of us go work there? The cool thing is if you have a fund that is a bunch of people who, if you did go work there, you'd be a pretty good startup.”

So, since Garry thinks creating autonomous taxis is interesting, as Cruise is doing, I’d assume many other exceptional engineers would think the same. Therefore, you could build a spectacular company off of a spectacular team that’s essentially too exceptional to fail.

By framing your investment decision on this principle, you actually de-risk your investment a lot because if you’re feeling convinced by the founder to join the ride, since they’re just so charismatic, determined, and intelligent that other people will see it, too. It’s a pretty straightforward assumption that the better the team, the better the potential outcome for a startup.

That’s why so many early-stage investors emphasize the founder and team most because many problems, if plausible, can be solved. What matters is whether these people are the ones to do it. So, if you believe they are, then others will likely feel the same way IF you’re a reputable builder yourself. I mean, you gotta have some credibility, right?

As we’ve touched on before, storytelling is such a vital skill for a founder because it’s the best way to attract exceptional employees. If you can create that aurora around autonomous vehicles (probably not that hard) or ocean freight (probably much harder), then you have visionary storytelling abilities. Initialized President Jen Wolf mentioned the importance of this when she said,

“I look a lot for how they tell the story of their company. What's both their long-term vision and marrying that with what are the first steps they've taken today? We want them to build not just a great product but also a great company. We always like to say like would I quit my job to work for this founder?

Can they sell that Vision to other people and hire a really great team who's just as passionate as they are about what they're doing, and have that North Star while also being able to build and get it done and change the world with what they're trying to build? Can they convey that Vision through storytelling to us and to people that they need to bring in: their customers, their employees, and their teammates? That's how you kind of make a really great company.”

I think it’s interesting when you think about companies now. Take Stripe, for example. It’s a payment processing company. That should not be that interesting, but the Collison brothers created the lure around working at Stripe because they had the vision to “Increase the GDP of the internet.”

Now that’s a cool company.

It’s like in a16z’s Five Questions essay where I discussed Martin Casado’s emphasis on nailing the mission early on. That visionary mission statement will be vital in framing your company in the eyes of potential employees, or you will be classified as just another payments company.

When I ask this question, I want the founder to be able to sell an incredible vision of the future that their company is creating. I want the founder to be enthusiastic about the challenging problems we could solve together.

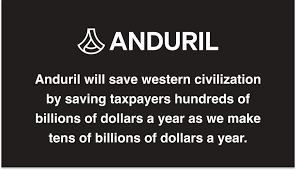

I don’t really know because, again, I’ve never been formally pitched by a startup, but I’d assume that if I heard just an incredible mission statement, that’d be enough to sell me. Stripe is a great example, but perhaps the defense-tech company Anduril is an even better one.

Again, just so good.

I guarantee you that this slide not only sold investors on investing in Anduril but also enticed thousands of top engineers to apply for a role within the company.

So founders, when you’re pitching a VC, act like you’re also pitching an employee you want on your team. Sell them the vision, convey why you want them, talk about all the awesome problems that will be solved, and cap it off with an awesome mission statement that gives butterflies to anyone who reads it.

Conclusion

So those are the five questions I’d ask if I were a partner at Initialized Capital based on what I’ve read from current and former partners. I hope you enjoyed this thought exercise, and that it helped make you a more prepared founder or investor.

As always, you can find the podcast version of this essay on SPOTIFY or APPLE PODCASTS. Additionally, all my notes are at allthingsvc.blog if you want to read more. For short snippets of the podcast episode, you can check out my YOUTUBE page. Lastly, for other snippets and just random thoughts that pop in my head, follow me on X (Twitter).

Next week, we will return to our traditional deep dive format on another exceptional VC firm. Make sure you subscribe so you don’t miss it!

Thanks for reading and have a great rest of your day!